Tax Blog

Tips to help you prepare for tax season

Sports Betting Will Not Solve State Budget Crises

Tax Policy - Sports Betting Will Not Solve State Budget Crises The coronavirus pandemic has left states and localities in dire straits financially and lawmakers are getting creative in their pursuit of new revenue sources. Sports betting is one such source....

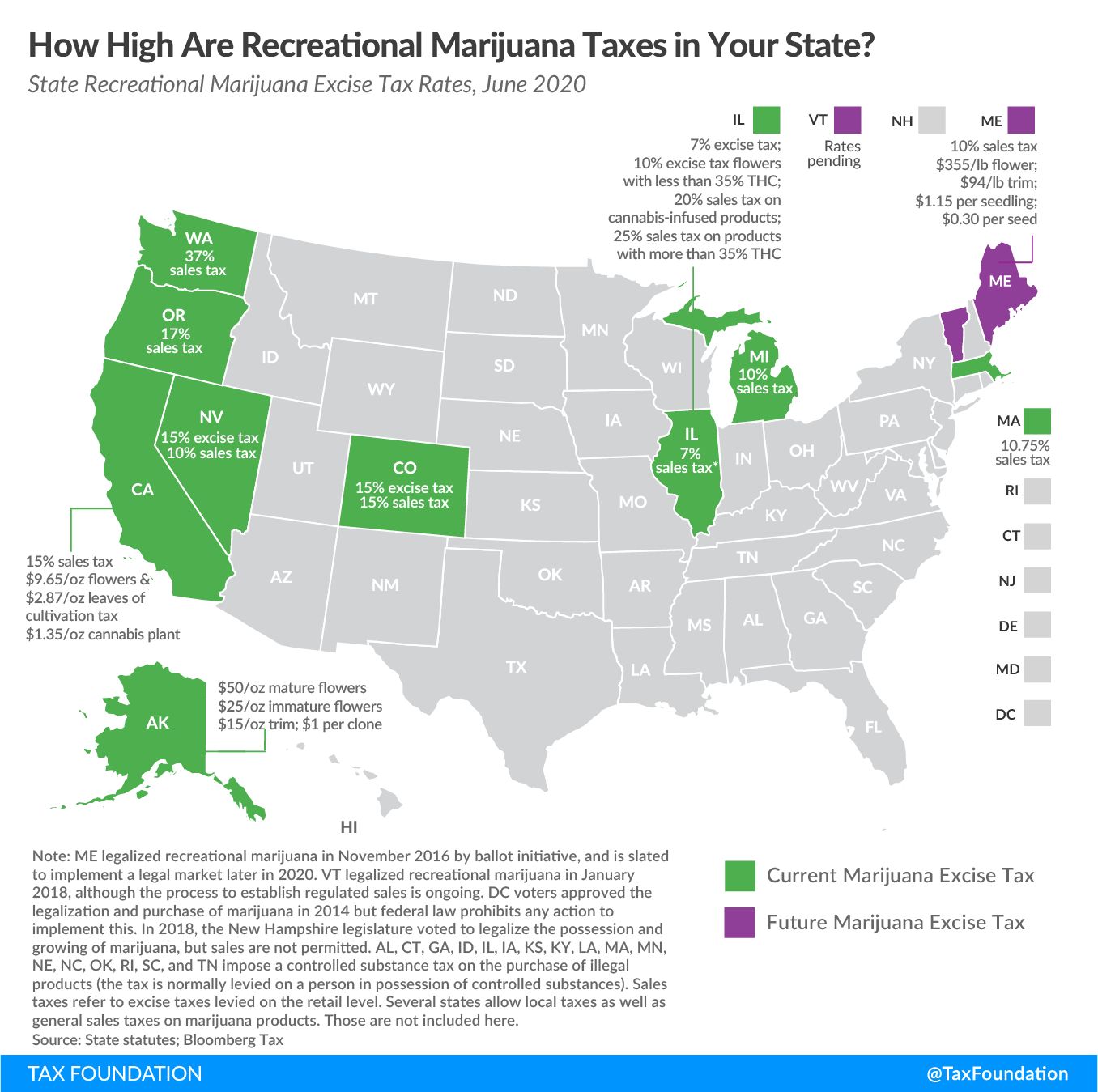

How High Are Taxes on Recreational Marijuana in Your State?

Tax Policy - How High Are Taxes on Recreational Marijuana in Your State? As the public grows more supportive of recreational marijuana, states deciding to legalize it must figure out their approach toward taxing cannabis sales. Eleven states (Alaska, California,...

PPP Loans for Small Businesses Boosted by AICPA

The American Institute of CPAs (AICPA) is encouraging small businesses to apply for Paycheck Protection Program (PPP) loans ahead of the June 30th deadline.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Rules proposed for direct primary care arrangements, health care sharing ministries

IRS Tax News - Rules proposed for direct primary care arrangements, health care sharing ministries The IRS issued proposed regulations defining direct primary care arrangements with doctors and health care sharing ministries and how payments for them can qualify...

AICPA recommends changes to e-signature requirements

IRS Tax News - AICPA recommends changes to e-signature requirements In a letter to the IRS, the AICPA asked the IRS to permanently amend its electronic signature procedures to make it easier for taxpayers and practitioners to e-file all types of returns. ...

California Senate Bill Seeks Tax Credit Transparency from Large Corporations but Misses the Mark

Tax Policy - California Senate Bill Seeks Tax Credit Transparency from Large Corporations but Misses the Mark If enacted, California Senate bill SB 972 would require the public posting of an annual list of corporate taxpayers whose gross receipts met or...