Tax Blog

Tips to help you prepare for tax season

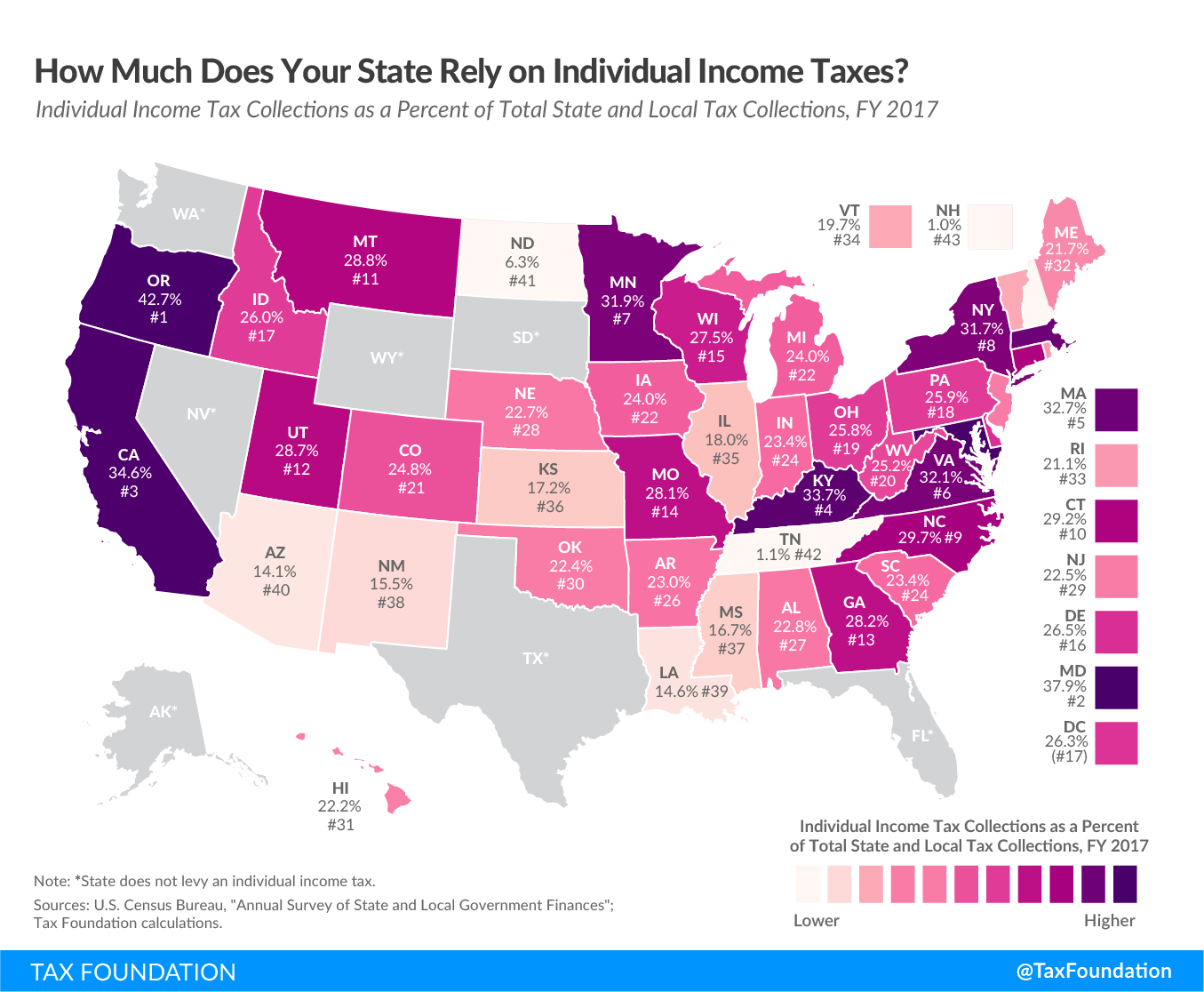

To What Extent Does Your State Rely on Individual Income Taxes?

Tax Policy - To What Extent Does Your State Rely on Individual Income Taxes? Sources of state revenue have come under closer scrutiny in light of the impact of the coronavirus outbreak, as different tax types have differing volatility and economic...

Proposed rules govern deductions and reporting for restitution

IRS Tax News - Proposed rules govern deductions and reporting for restitution The IRS issued regulations explaining the allowance of deductions for certain fines and penalties under Sec. 162(f) as amended by the law known as the Tax Cuts and Jobs Act. ...

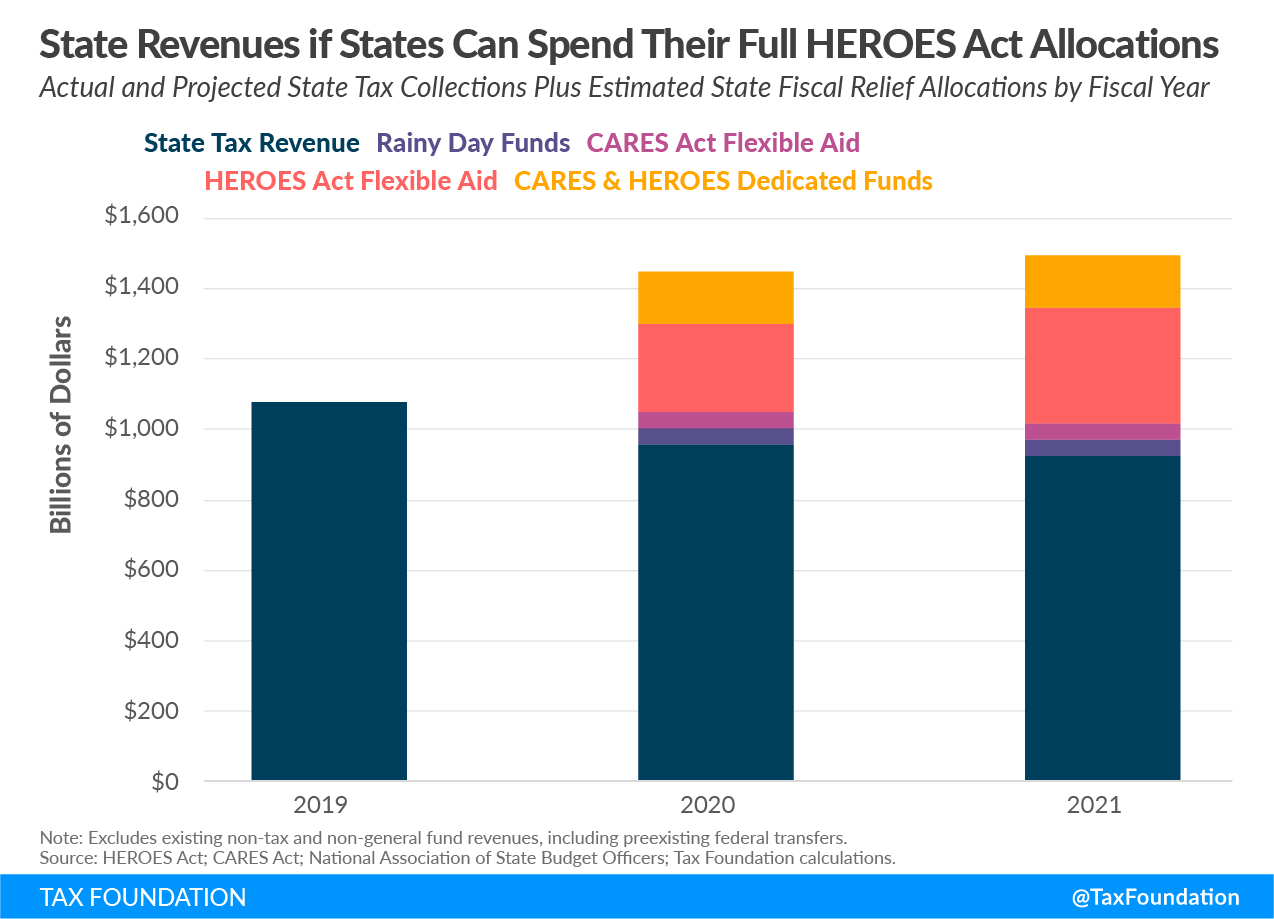

Under the HEROES Act, State Budgets Could Soar as the Economy Suffers

Tax Policy - Under the HEROES Act, State Budgets Could Soar as the Economy Suffers The HEROES Act, proposed by House Democrats as a next round of fiscal relief during the coronavirus outbreak, contains about $1.08 trillion in aid to states and localities. That...

Treasury Wants Payments to Deceased Taxpayers Returned

The U.S. Treasury Department has found a loophole in the stimulus payments sent out to individuals. Some of the recipients were actually deceased—and Treasury wants that money back.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

How the HEROES Act Would Allocate State and Local Aid

Tax Policy - How the HEROES Act Would Allocate State and Local Aid The HEROES Act, introduced Tuesday by House Democrats, provides more than $1 trillion to state and local governments, including $915 billion in flexible aid—which can be spent for any purpose,...

IRS allows midyear changes to health coverage, dependent care elections

IRS Tax News - IRS allows midyear changes to health coverage, dependent care elections In response to the coronavirus pandemic, the IRS is allowing employers to permit their employees to change their health coverage elections or dependent care elections during...