Tax Blog

Tips to help you prepare for tax season

Watch: Coronavirus: A Path to Economic Recovery

Tax Policy - Watch: Coronavirus: A Path to Economic Recovery So far, the federal government has focused on short-term policies to stem the spread of COVID-19 and provide immediate relief, but soon they will need to address what may prove to be an even more...

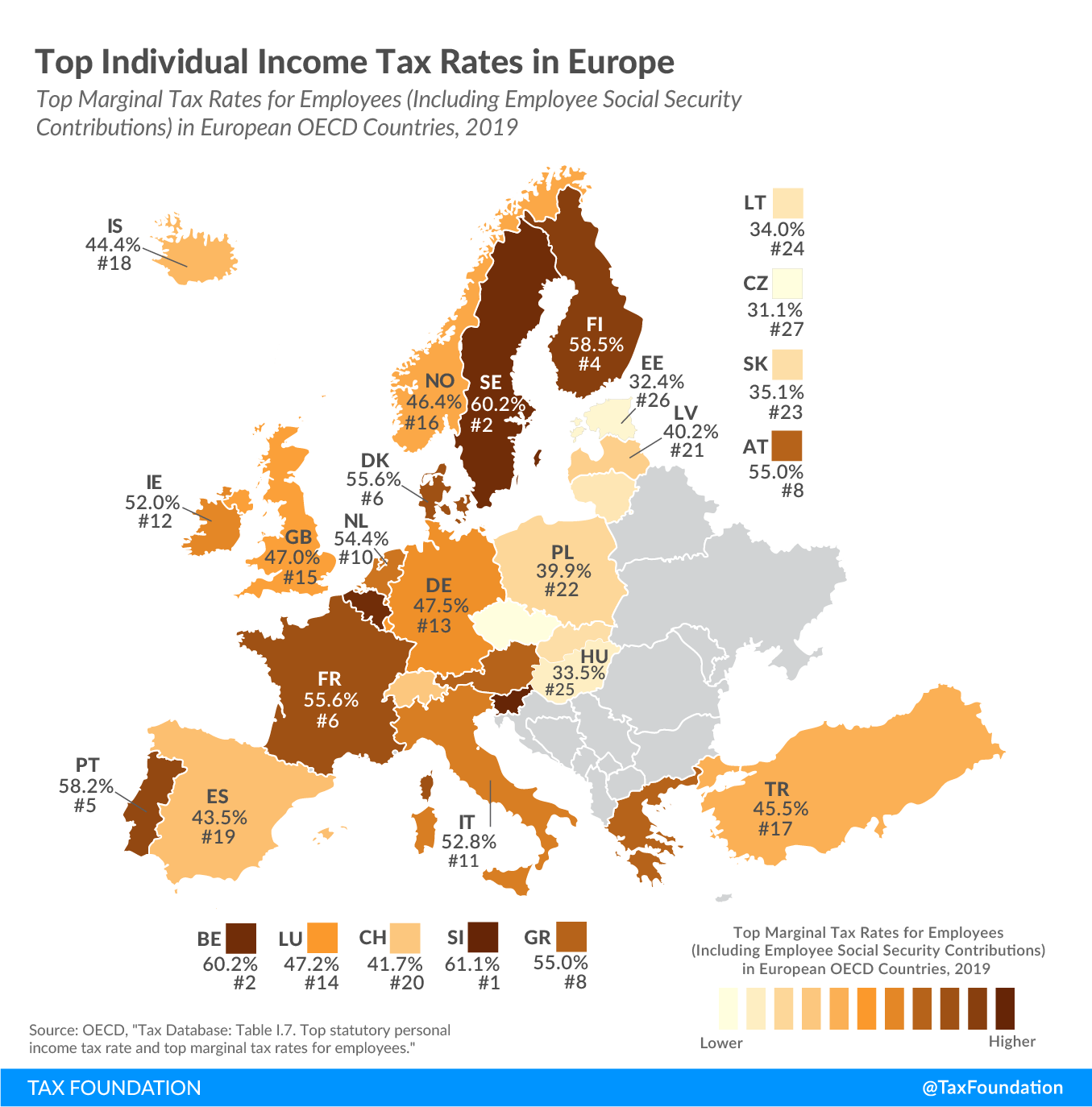

Top Individual Income Tax Rates in Europe

Tax Policy - Top Individual Income Tax Rates in Europe Most countries’ individual income taxes have a progressive structure, meaning that the tax rate paid by individuals increases as they earn higher wages. The highest tax rate individuals pay differs...

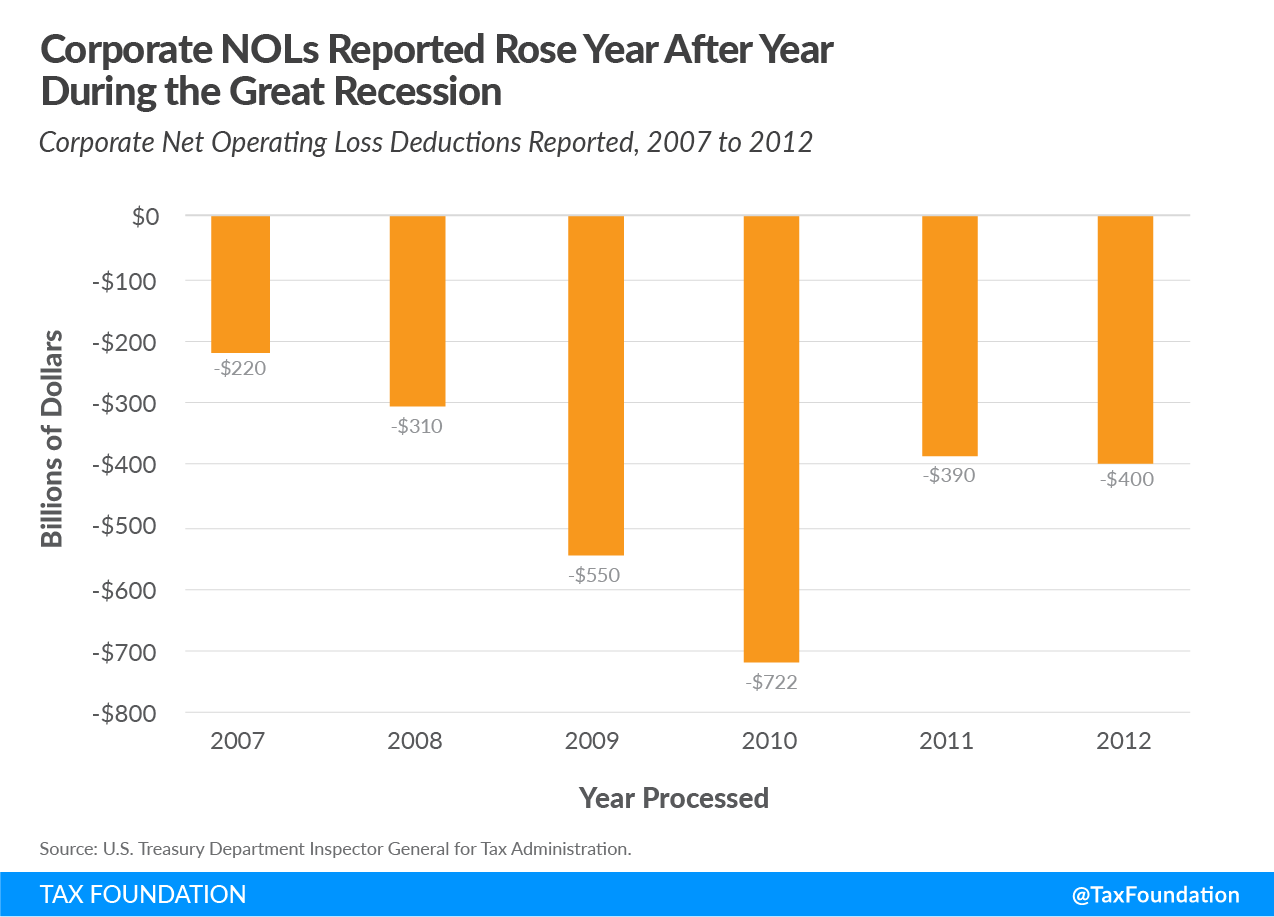

Advancing Net Operating Loss Deductions in Phase 4 Business Relief

Tax Policy - Advancing Net Operating Loss Deductions in Phase 4 Business Relief Key Findings The Coronavirus Aid, Relief, and Economic Security (CARES) Act provided economic relief to businesses in part by modifying net operating loss (NOL) deduction rules,...

IRS Urges Low-Income Non-Filers to Use EIP Reporting Tool

The Internal Revenue Service reminded low-income Americans who don’t normally file a tax return that they are probably eligible to receive an Economic Impact Payment.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

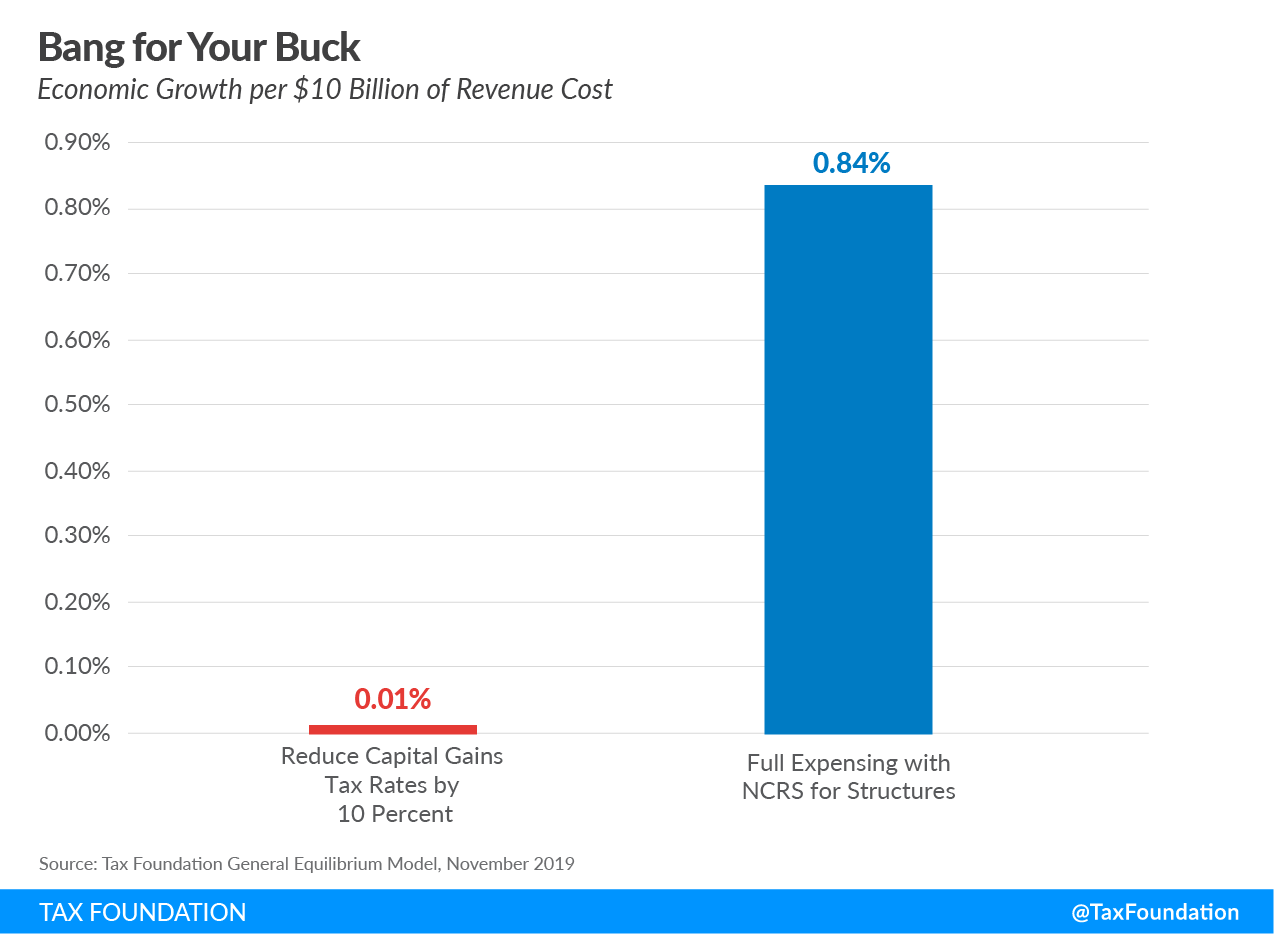

White House Considers Neutral Cost Recovery for Structures

Tax Policy - White House Considers Neutral Cost Recovery for Structures The White House and congressional lawmakers are weighing policies to include in the next round of coronavirus response legislation. Some policies are geared toward helping people and...

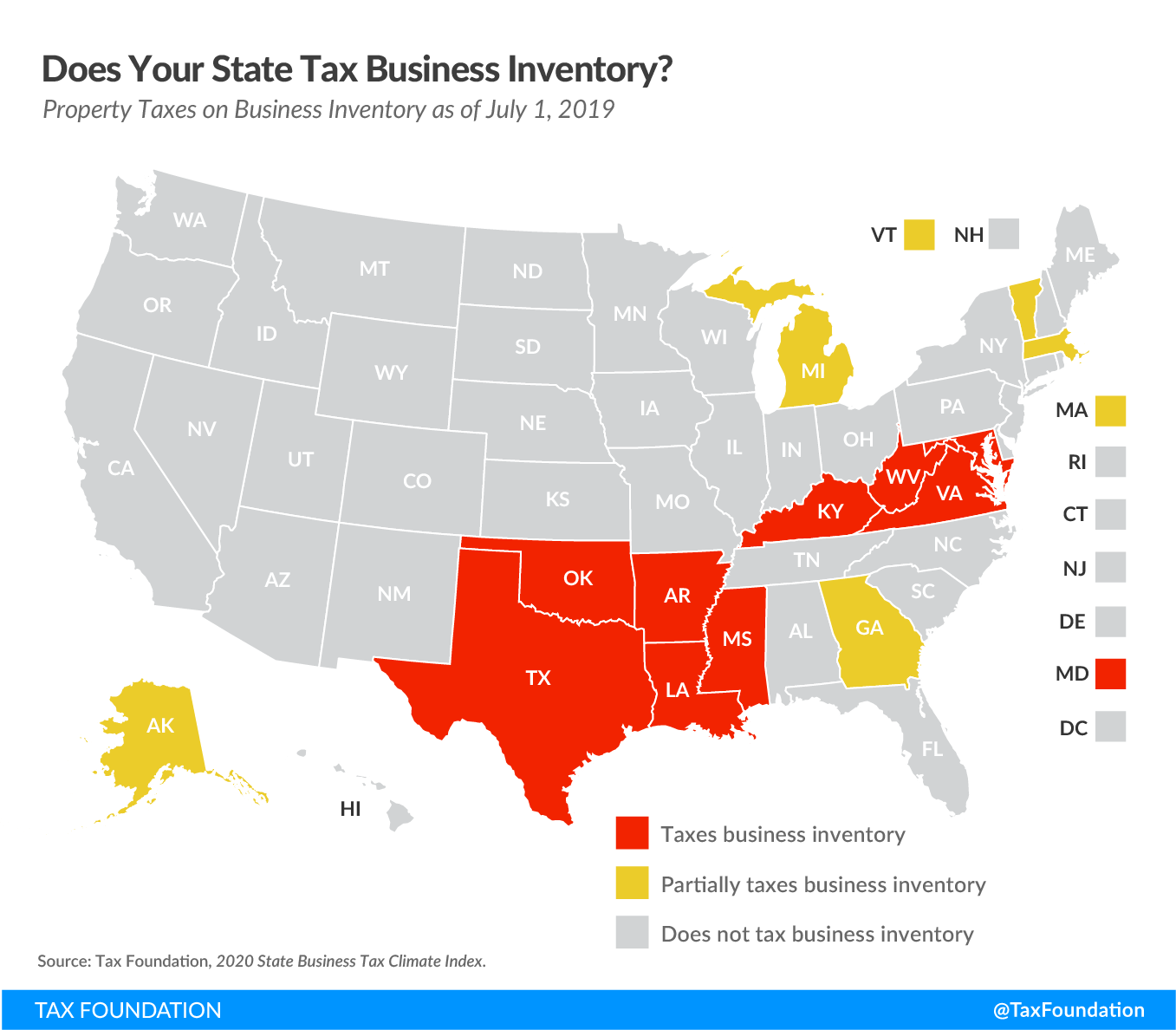

Does Your State Tax Business Inventory?

Tax Policy - Does Your State Tax Business Inventory? As we continue to look at tax types that can harm states’ post-coronavirus recovery, it’s worth highlighting taxes on business inventory. Inventory taxes fall under the umbrella of the property tax, which is...