Tax Blog

Tips to help you prepare for tax season

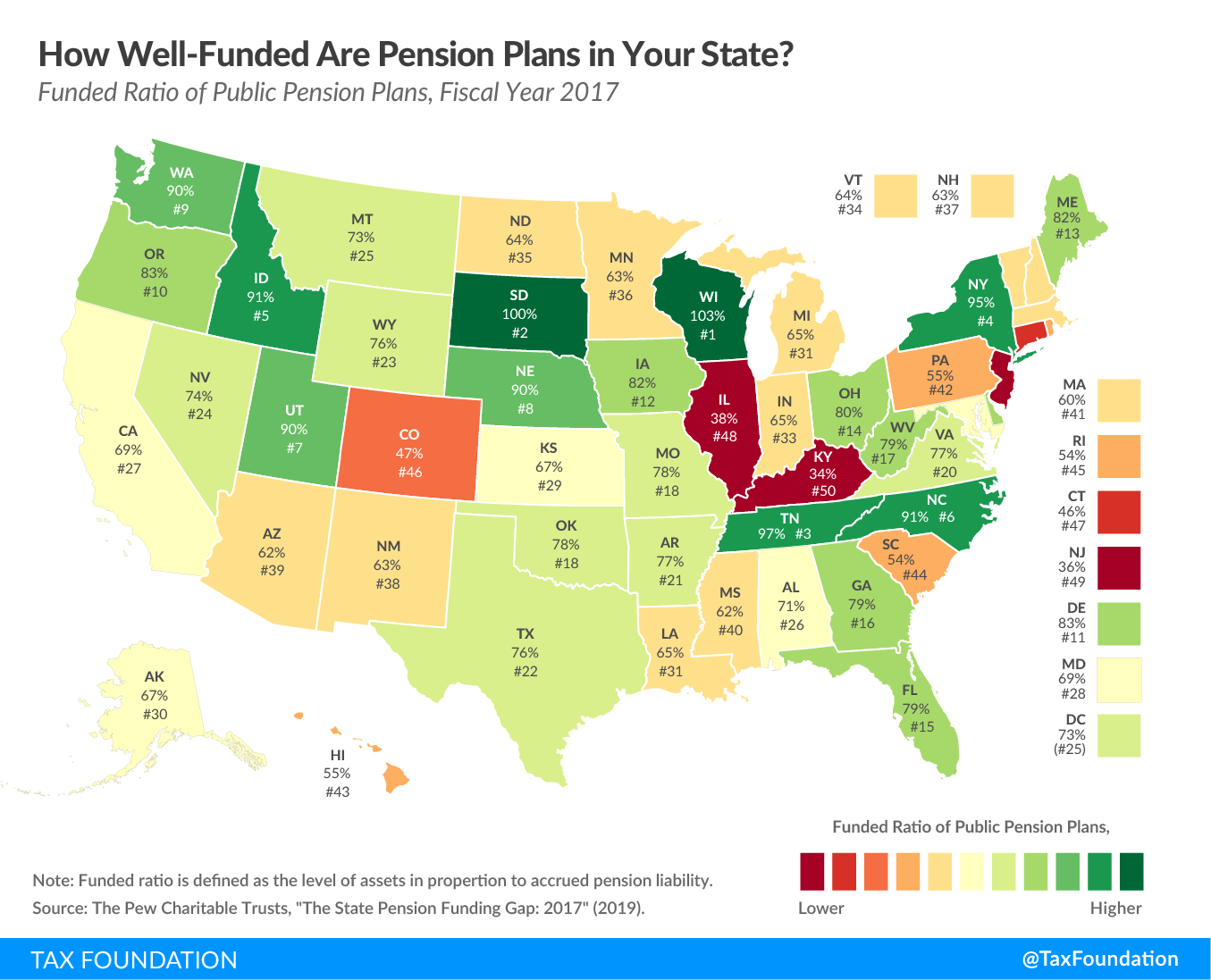

How Well-Funded Are Pension Plans in Your State?

Tax Policy - How Well-Funded Are Pension Plans in Your State? The most recent data from The Pew Charitable Trusts, released in July of 2019, shows the strain on state retirement systems nationwide as state pension funds strive to keep pace with benefits owed to...

A Review of Net Operating Loss Tax Provisions in the CARES Act and Next Steps for Phase 4 Relief

Tax Policy - A Review of Net Operating Loss Tax Provisions in the CARES Act and Next Steps for Phase 4 Relief In addition to providing economic relief to individuals and loans to businesses struggling during the coronavirus crisis, the Coronavirus Aid, Relief,...

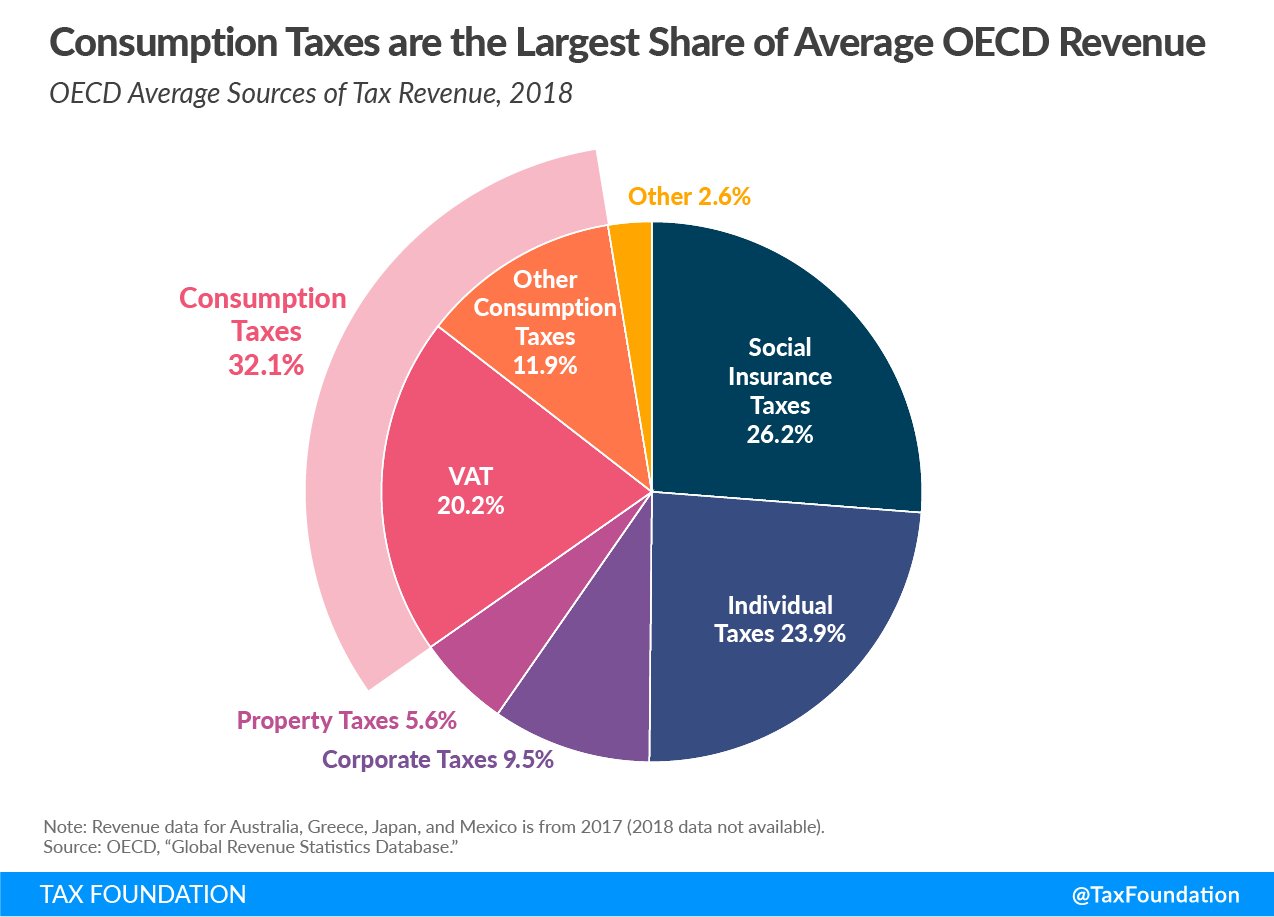

New OECD Study: Consumption Tax Revenues during Economic Downturns

Tax Policy - New OECD Study: Consumption Tax Revenues during Economic Downturns The current economic shutdown—potentially followed by an economic downturn—affects government budgets not only through increased spending but also through a decline in tax revenues....

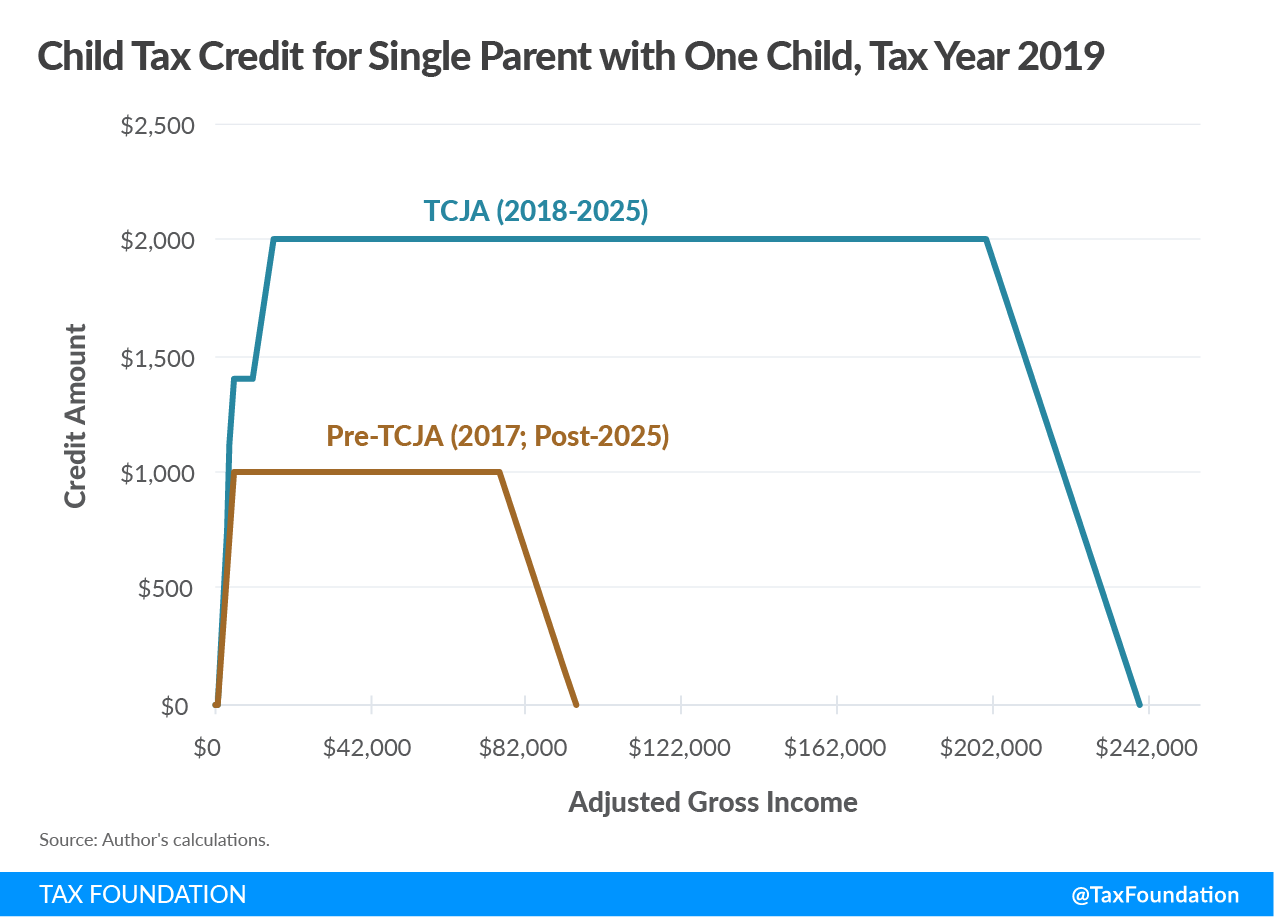

The Child Tax Credit: Primer

Tax Policy - The Child Tax Credit: Primer Key Findings The Child Tax Credit (CTC) is a partially-refundable tax credit available to parents with qualifying dependents under the age of 17. Like other tax credits, the CTC reduces tax liability dollar-for-dollar of...

IRS Expands More Tax Deadlines

The Internal Revenue Service says it is extending additional tax deadlines for individuals and businesses.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

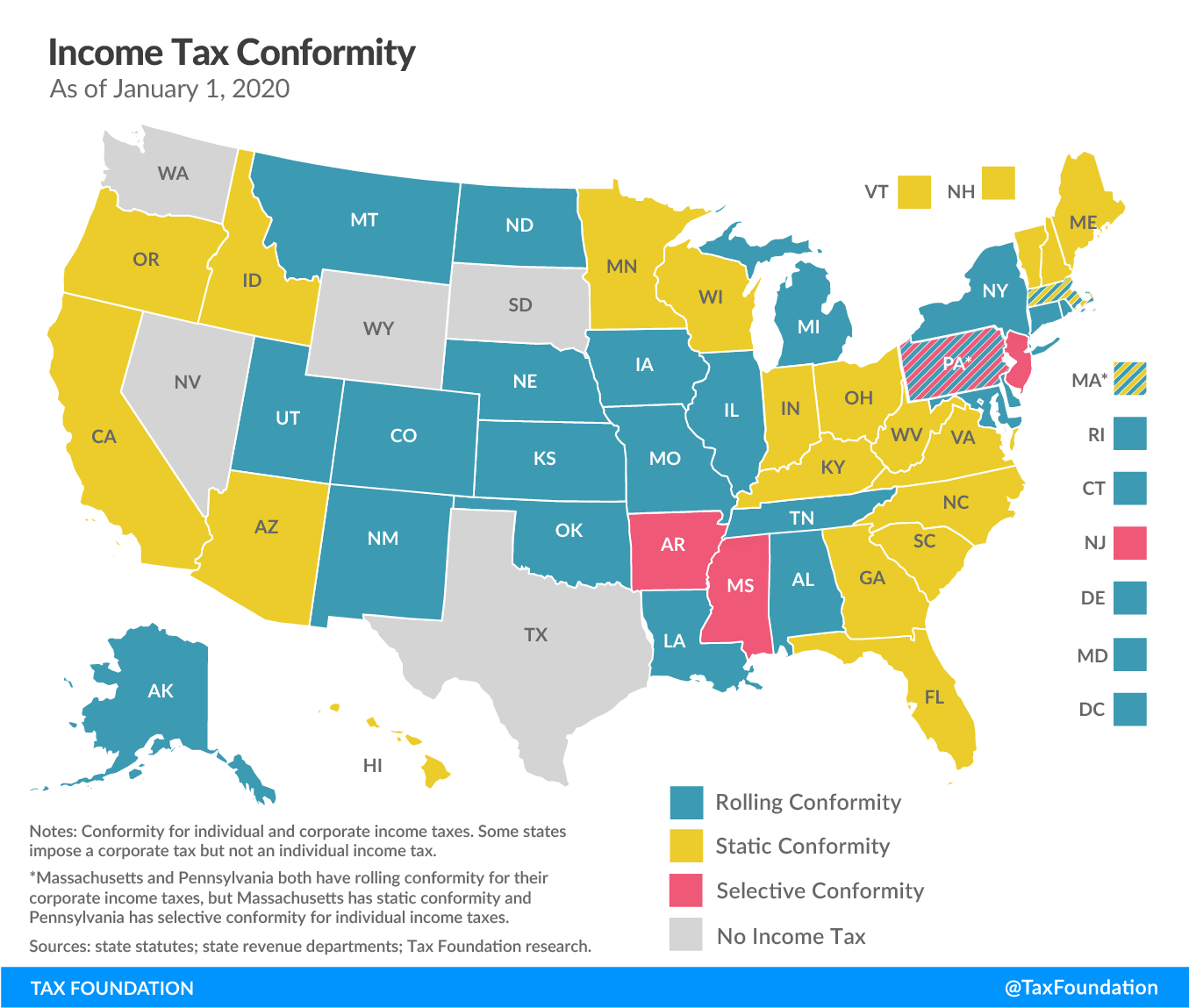

Will States Tax the Federal Government’s COVID-19 Lifeline to Small Businesses?

Tax Policy - Will States Tax the Federal Government’s COVID-19 Lifeline to Small Businesses? The federal government is offering small businesses a lifeline in the form of loans that can be forgiven if they use the money for specified purposes (like payroll, rent...