Tax Blog

Tips to help you prepare for tax season

Testimony: Kansas Tax Modernization: A Framework for Stable, Fair, Pro-growth Reform

Tax Policy - Testimony: Kansas Tax Modernization: A Framework for Stable, Fair, Pro-growth Reform The following is our testimony to Kansas’ Senate Committee on Assessment and Taxation; and Kansas’ House Committee on Taxation Presenting: Kansas Tax Modernization:...

IRS Celebrates 14th Annual EITC Awareness Day

The Internal Revenue Service wants more taxpayers to know about the Earned Income Tax Credit, which is why the agency has coordinated the annual EITC Awareness Day event for more than a decade.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Electronic filing mandated for Sec. 501(c)(3) applications

IRS Tax News - Electronic filing mandated for Sec. 501(c)(3) applications The IRS announced that Form 1023, Application for Recognition of Exemption Under Section 501(c)(3), must now be submitted electronically. Source: IRS Tax News - Electronic filing...

Profit Shifting: Evaluating the Evidence and Policies to Address It

Tax Policy - Profit Shifting: Evaluating the Evidence and Policies to Address It Over the last decade there have been serious efforts by many countries to change tax rules to address profit shifting by multinational businesses. Research on the size and the scope...

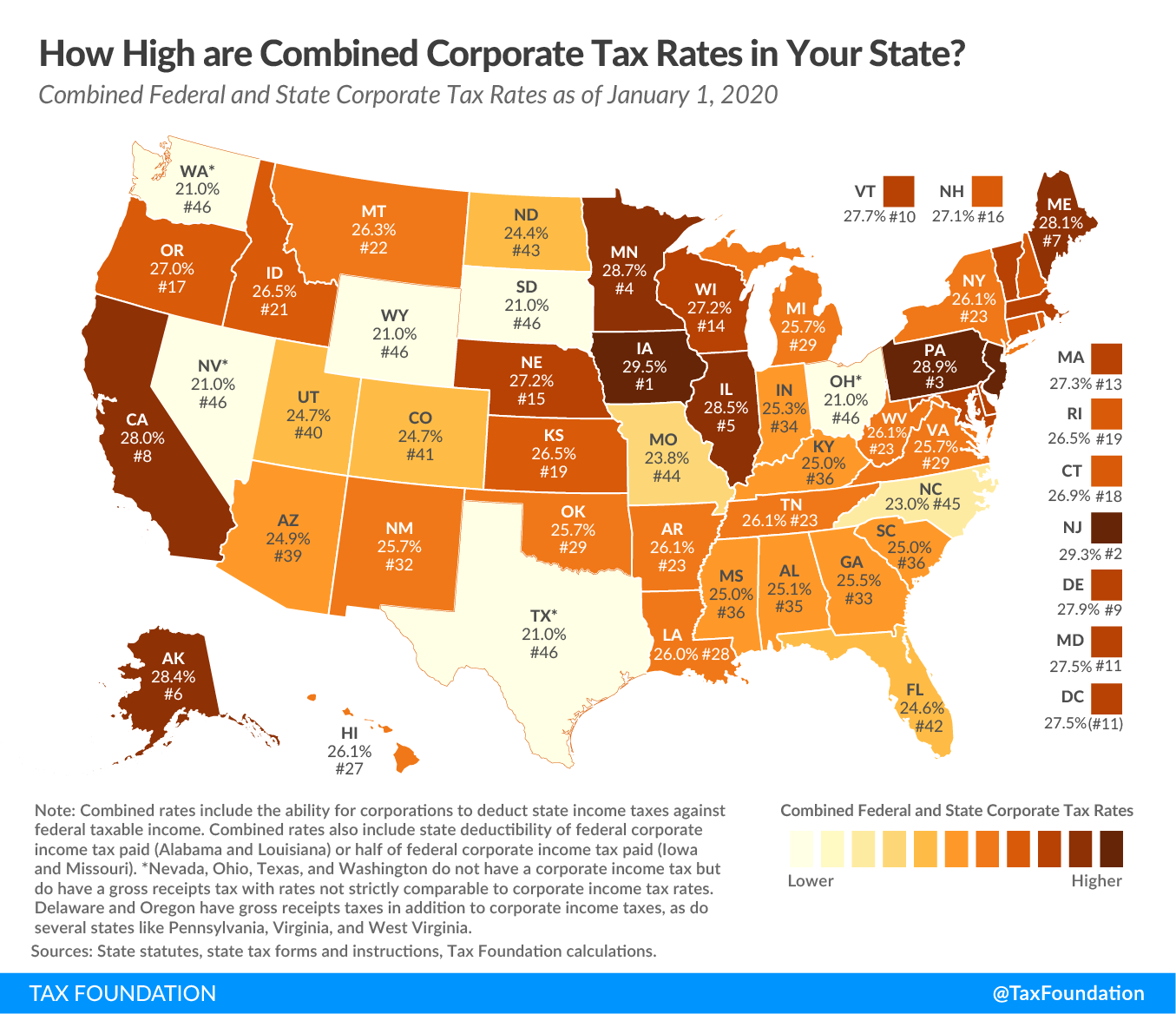

Combined State and Federal Corporate Income Tax Rates in 2020

Tax Policy - Combined State and Federal Corporate Income Tax Rates in 2020 Corporations in the United States pay federal corporate income taxes levied at a 21 percent rate. Many states also levy taxes on corporate income. Forty-four states and D.C. have...

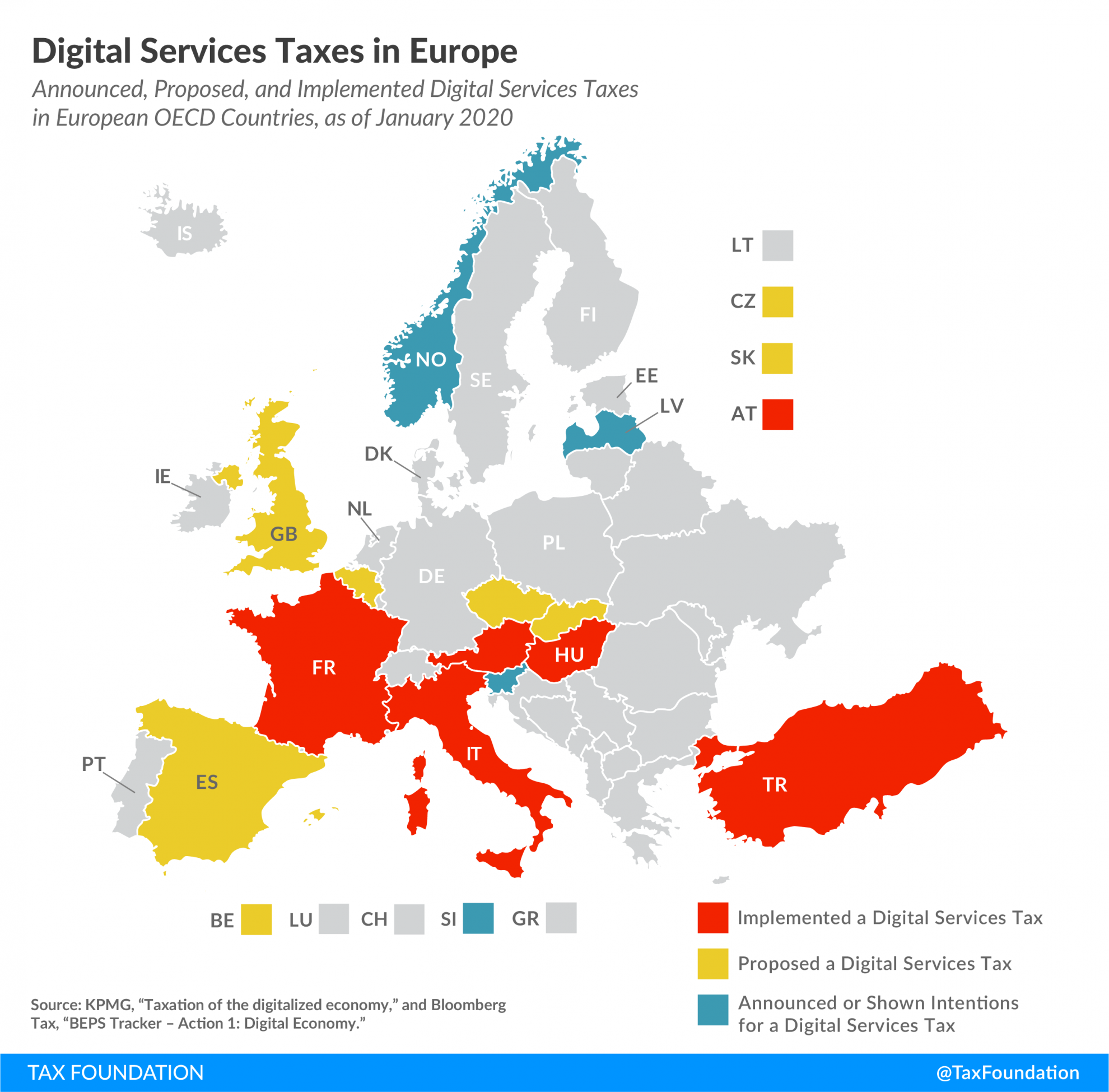

FAQ on Digital Services Taxes and the OECD’s BEPS Project

Tax Policy - FAQ on Digital Services Taxes and the OECD’s BEPS Project Questions What is a digital services tax? What is the EU digital tax proposal? What is France’s digital tax proposal? What is the UK’s digital tax proposal? What countries have announced,...