Tax Blog

Tips to help you prepare for tax season

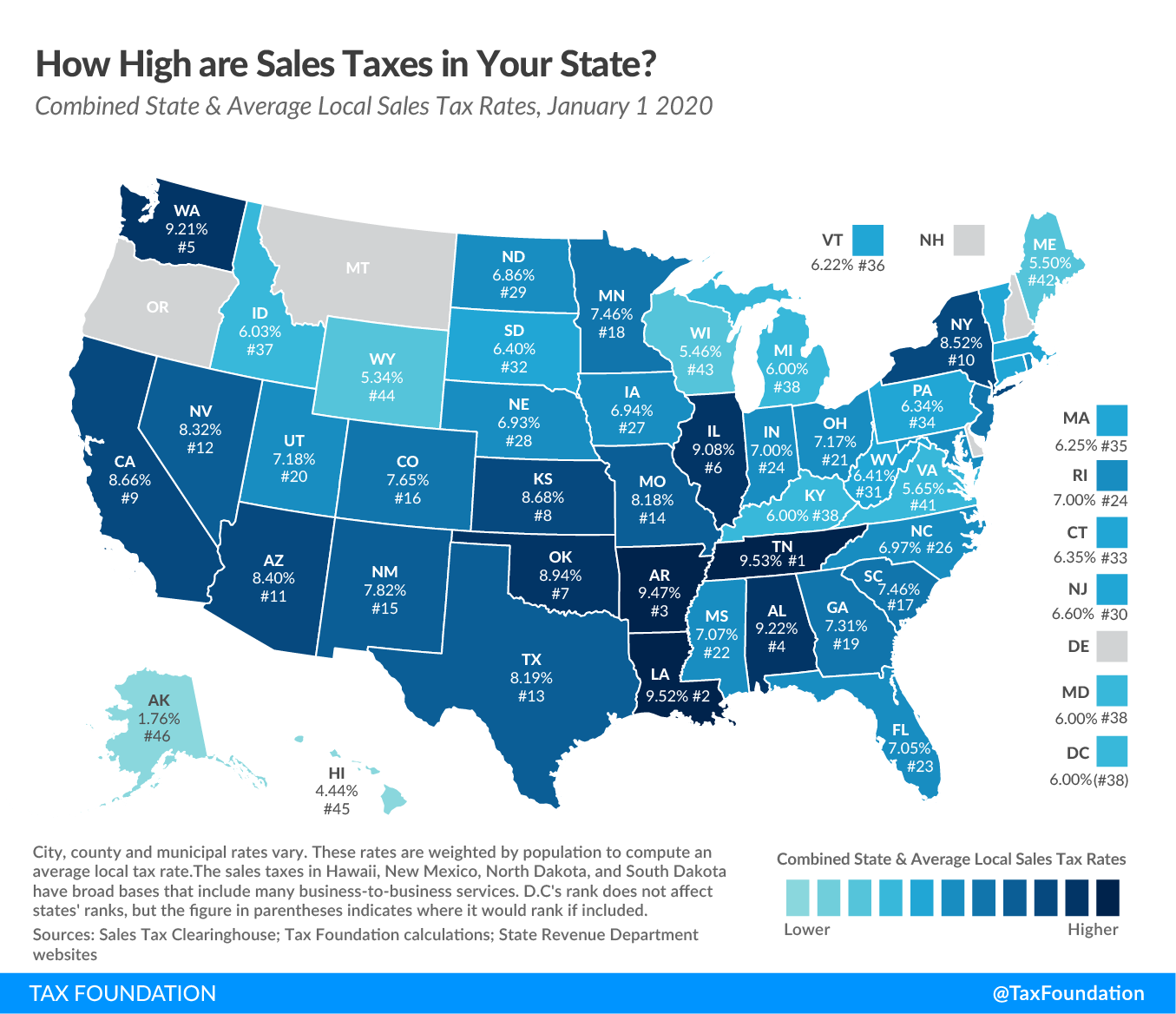

State and Local Sales Tax Rates, 2020

Tax Policy - State and Local Sales Tax Rates, 2020 Key Findings Forty-five states and the District of Columbia collect statewide sales taxes. Local sales taxes are collected in 38 states. In some cases, they can rival or even exceed state rates. The five states...

Gig Economy Workers Get Boost from New IRS Dedicated Tax Center

Tax Policy - Gig Economy Workers Get Boost from New IRS Dedicated Tax Center Last week, the Internal Revenue Service (IRS) launched the Gig Economy Tax Center aimed at helping gig economy participants understand and meet their tax obligations. This center is a...

How Controlled Foreign Corporation Rules Look Around the World: China

Tax Policy - How Controlled Foreign Corporation Rules Look Around the World: China The Chinese Controlled Foreign Corporation (CFC) regime was adopted in 2008. CFC rules in China are not commonly enforced, and the government relies more on the application of...

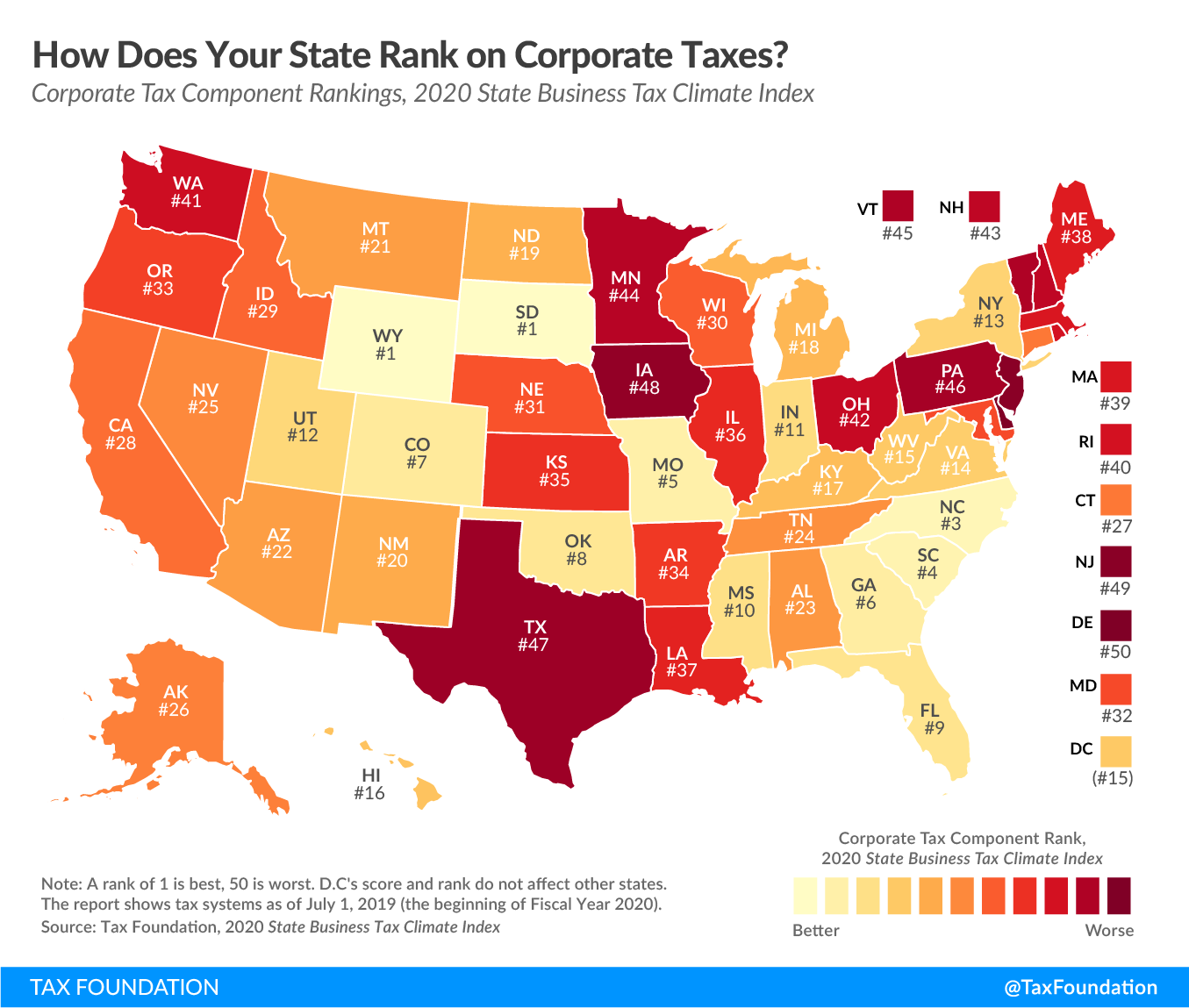

Massachusetts Should Create a More Neutral, Competitive Corporate Excise Tax

Tax Policy - Massachusetts Should Create a More Neutral, Competitive Corporate Excise Tax Several of Massachusetts’ largest employers have created a coalition to seek a change to Massachusetts’ corporate income apportionment formula. The coalition wants...

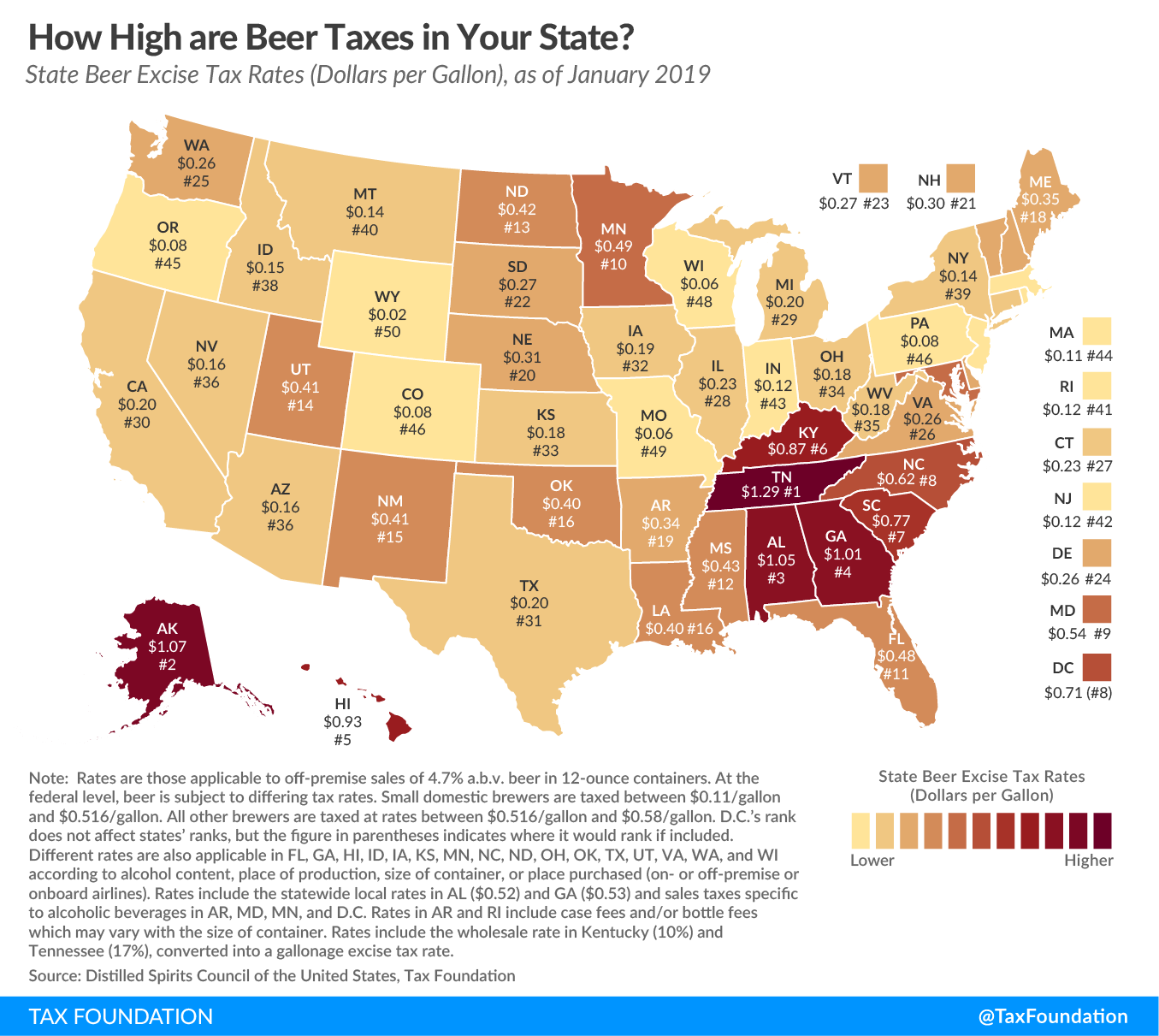

Proposal to Increase New York Beer Tax

Tax Policy - Proposal to Increase New York Beer Tax Commercial brewing of beer has been part of New York state since 1632, when Dutch settlers opened the first brewery in Manhattan. The brewing tradition continued through the centuries, peaking in 1876 with 393...

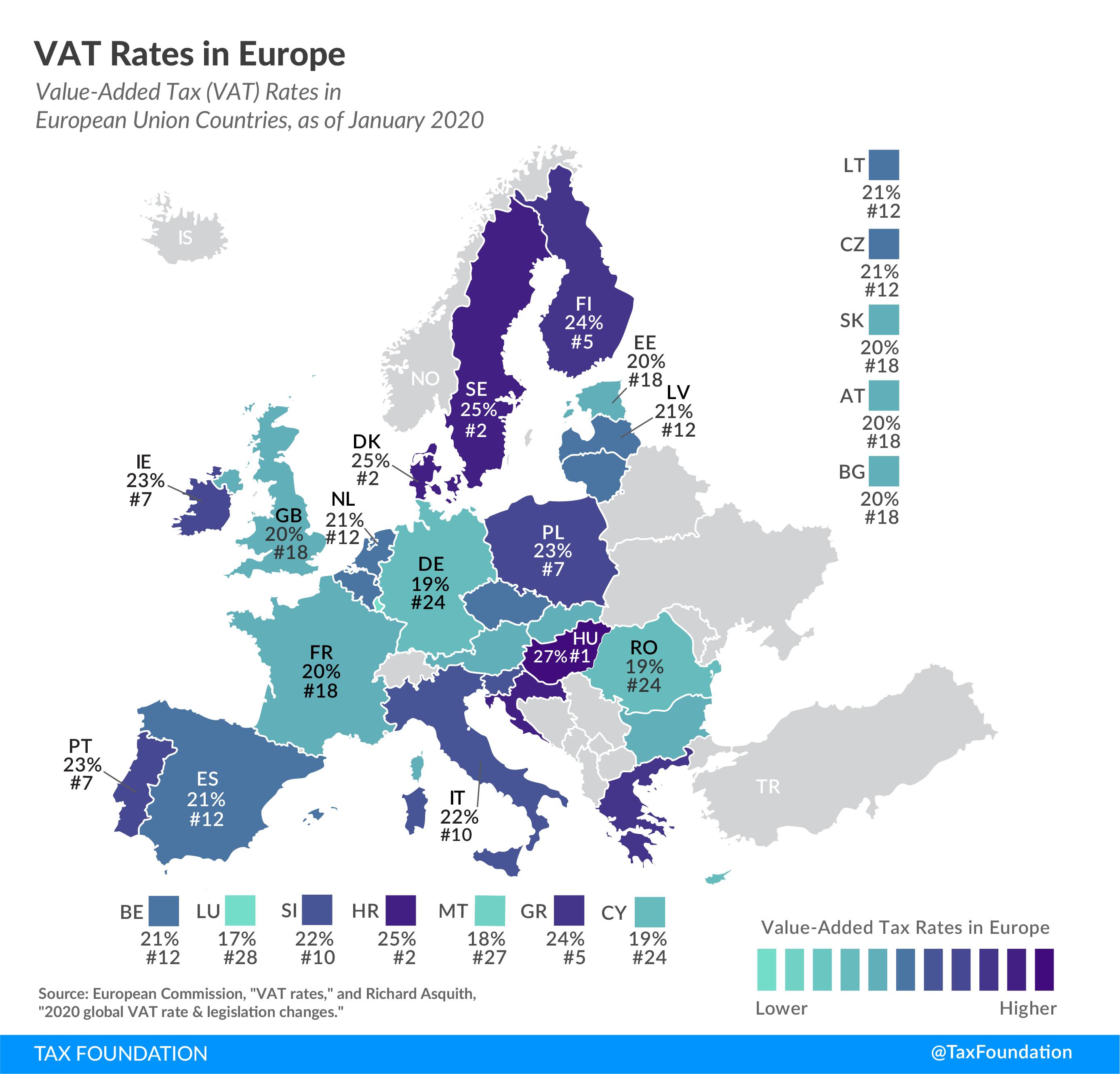

2020 VAT Rates in Europe

Tax Policy - 2020 VAT Rates in Europe More than 140 countries worldwide—including all European countries—levy a Value-Added Tax (VAT) on purchases for consumption. As today’s tax map shows, although harmonized to some extent by the European Union (EU), EU member...